Business Bundle Relationship Checking

Bundle Includes:

Merchant Services

Free credit card machine up to $300 value with new merchant account.

Surcharge-Free ATMs

Access 40,000+ surcharge-free ATMs through the Allpoint Network

Commercial Line of Credit

Get a line of credit for your business and we will waive our annual commitment fee of $250 for the first year.

Remote Deposit Capture

We will waive the monthly service fee for RDC, which allows you to deposit checks in large batches.

Positive Pay

Positive Pay is an anti-fraud tool that detects and prevents fraudulent check transactions.

Online and Mobile Banking Access

Unlimited Deposits, Withdrawals & Check Writing

PLUS

Power Advantage

Personal Checking Account

We will waive the monthly service charge for our interest-bearing checking account

Premium Rates on CDs

Get the best rates Rondout Savings Bank has to offer!

Premium Rates on CDs

Get the best rates Rondout Savings Bank has to offer!

Account Details

MONTHLY SERVICE CHARGE

$25.00

HOW TO AVOID MONTHLY SERVICE CHARGE

• Enroll in Online Banking with access 5 times per cycle.

• Enroll in E-statements.

• 4 Monthly ACH’s per cycle

MINIMUM DEPOSIT TO OPEN

$500.00

EARLY CLOSE OUT FEE

$25 fee when account is closed within 90 days of opening

Let us help you grow your business

Request an Appointment

"*" indicates required fields

Business Bundle Money Market Special

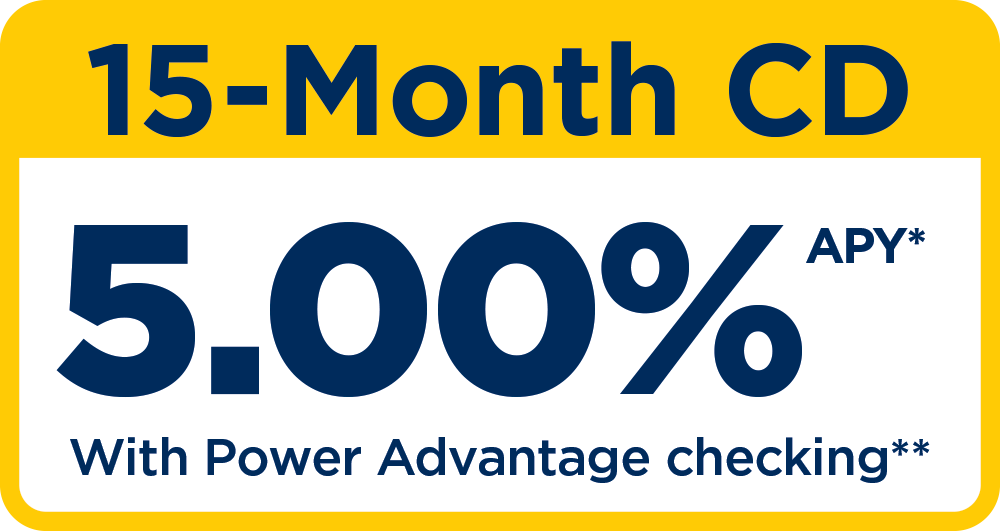

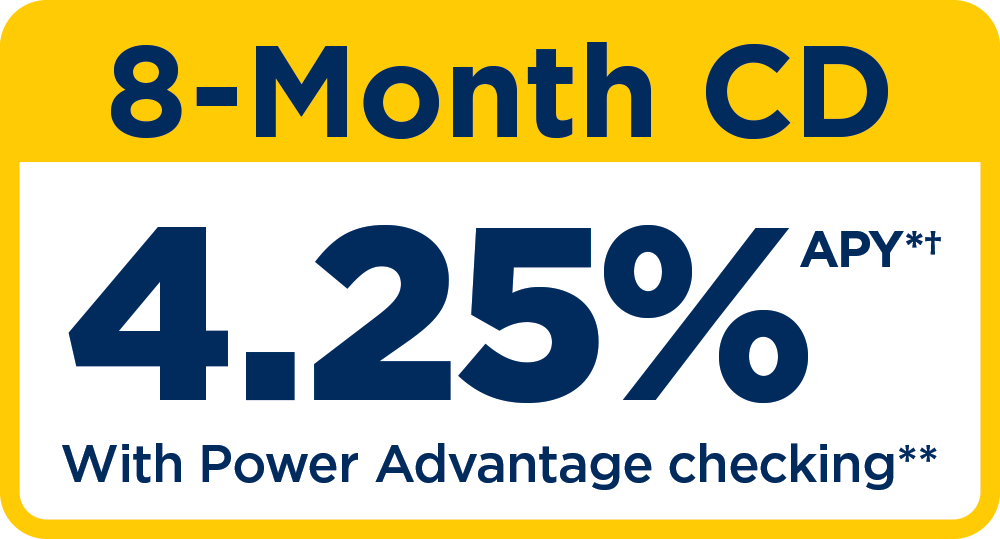

Two Great CD Offers!

Our Locations

Terri Ferris,

Branch Manager

(845) 331-0073

tferris@rondoutsavings.com

Leah Baxter,

Branch Manager

(845) 382-2200

lbaxter@rondoutsavings.com

Drive-up services only, all banking transactions available at our Wall St. location.

Leah Baxter,

Branch Manager

(845) 382-2200

lbaxter@rondoutsavings.com

Rania Fakhoury,

Branch Manager

(845) 679-2600

rfakhoury@rondoutsavings.com

Pedro W MillaPedrozo,

Branch Manager

(845)-334-4102

pmillapedrozo@rondoutsavings.

Terri Ferris,

Branch Manager

(845) 331-0073

tferris@rondoutsavings.com

We reserve the right to modify or discontinue this promotion at any time without prior notice.

For over 150 years Rondout Savings Bank has been giving back to the community. With our "Dividends to the Community Program” we donate 10% of our earnings each year back into the communities we serve.

* APY=Annual Percentage Yield. The annual percentage yields are effective as of the publication date and are subject to change. 15-month and 8-month Certificate of Deposit – Minimum deposit to open and earn interest is $500. A penalty may be imposed for early withdrawal. Other terms and conditions may apply. Fees may reduce earnings. FDIC insured.

** Power Advantage Checking – $500 minimum to open and $1000 minimum to earn interest. Power Advantage Checking has a monthly service charge of $14.00 that can be avoided by maintaining a combined balance of $50,000.00 from eligible personal accounts. Rates may change after account opening.

*** APY=Annual Percentage Yield. The annual percentage yield is effective as of the publication date and is subject to change.

† Not eligible as an IRA

Copyright 2024 - Rondout Savings Bank